If you've been lucky enough to amass over 100 million Baht (approximately $3M), then your estate will be unlucky enough to be caught in Thailand's inheritance tax threshold.

Few of us have managed to squeeze that much out of our stay in Thailand, but there's a lot more to think about than that.

What if your wife dies before you? Do you benefit from her estate?

And what of single guys / girls who hold assets such as condos and cars in Thailand, who gets their greedy paws on those when you buy your farm in the sky?

And what if you die without a will (intestate)?

The fact is, few people know where they stand on such matters, thus the need for this article.

In this post, I'll explore the ins and outs of Thai inheritance tax law, including what happens to your assets if you die in Thailand, and what you stand to inherit if your wife/husband dies before you.

Image credit: Newsish.com

Who Pays Inheritance Tax in Thailand?

Unless you're sitting on $3m of money earned in Thailand, then your assets won't be subject to IHT.

If you are, your heirs will pay 5 or 10 percent – depending on their relationship to you – on anything over that amount

The law states:

The inheritance tax is 5 per cent for ascendants or descendants and 10 per cent for others. It is levied on assets worth above Bt100 million.

IHT is levied on heirs who are either individuals or Thai juristic persons. It is also applied to non-Thai nationals who are resident in Thailand according to the immigration law, and non-Thais inheriting assets located in Thailand.

This means that your Thai wife, or full or half Thai child, will pay IHT on your estate if it meets the threshold.

But really, who has this kind of wealth in Thailand? you might ask.

Many more than people tend to think, actually.

Wealthy Thais are far wealthier than we might perceive, and as such the government expects to collect 3 Billion Baht per year at the 5 percent rate.

Gift / Personal Income Exemptions

Like most countries, to counter possible avoidance of inheritance tax, a gift tax was also introduced by way of amending the types of tax-exempt income in the Thai Revenue Code.

The types of income exempt from personal income tax include income derived from maintenance, income derived under moral obligation, inheritance, or a gift received in a ceremony or on other occasions in accordance with established custom.

The law will only exempt the following types of income from personal income tax:

The portion of inheritance income not exceeding 100 million Baht under Section 12 of the Inheritance Tax Act.

Income derived from the transfer of ownership or possessory right in an immovable property without consideration by the parent to a legitimate, non-adopted child, only for the portion not exceeding 20 million Baht per tax year.

Income derived from maintenance or a gift from ascendants, descendants or a spouse, only for the portion not exceeding 20 million Baht per tax year.

Income derived from maintenance under moral purposes, or a gift received in a ceremony or on occasions in accordance with custom and tradition from persons who are not ascendants, descendants or a spouse, only for the portion not exceeding 10 million Baht per tax year.

Income from gifts received for use for religious, educational or public purposes according to the rules and conditions under a ministerial regulation (yet to be issued).

Yes, I'm sure you can see how a bunch of rich folks will find loopholes here and pay diddly squat. At which point the threshold will no doubt be lowered to scoop up those on moderate incomes.

Thanks to Benjamas Kullakattimas, Head of Tax at KPMG Thailand, for providing the English interpretations of the above list.

What Happens to My Assets When I Die in Thailand?

Single guys and unmarried guys in relationships might wonder what will become of their condo and Honda Click should they bite the bullet. The hard and fast truth is, if you have assets in Thailand, you need to make a will.

You should have a will for both your assets in Thailand and any that you hold in your home country.

When you die in Thailand, a government officer requests a copy of a will either from the family or the lawyer of the deceased.

In short, the will filed in your home country will not cover any property in Thailand.

Failing to have a will could result in lengthy, costly probate.

Without a will in Thailand, these assets are the property of your Thai estate and would be subject to Thai inheritance tax, if they total over the 100 million Baht mark.

For the married, your assets are distributed according to Thai law, and this means that family members are given priority (see the next section).

If you should die with no will, and there is no family or said heirs, then the state has the right to take all your property and sell it as it sees fit. Gasp!

If you have accumulated assets in Thailand that you don't want to end up in the state's purse, then you really should consider making a will in your home country that includes these assets, so that your relatives are aware of what you have and who is heir to them.

You should also file a will in Thailand too.

In order to register a will in Thailand and have an executor appointed, you must go to a provincial court. The executor will then get the court’s authority to dispose of the person’s assets in accord with their will. Of course a Thai lawyer can arrange this for you.

+ Read: How to Make a Will in Thailand

Will I Inherit My Wife's Fortune?

If she leaves it to you in her will, then yes. But please do read below about land and property.

If your wife doesn't leave a will, you better get in line, because, see that list below, that's you at #7, at the bottom of the queue:

In Thailand there are 6 classes of statutory heirs and they are entitled to inherit in the following order:

- Descendants

- Parents

- Brothers and sisters of full blood

- Brothers and sisters of half blood

- Grandparents

- Uncles and aunts

- The surviving spouse is a statutory heir, subject to the special provisions of Section 1635 Civil and Commercial Code.

You wife might choose to leave you money, gold, or perhaps her car. But if you expect to inherit these things, you'd do well to encourage her to make a will that stipulates exactly what she wants to leave you, and for her to instruct her family of her wishes, so there is no dispute.

Family disputes are common in this regard.

If family members seize assets after a death, the process for a foreigner getting them back, even with the presence of a will, is a very difficult one.

This is certainly something you should think about if you have a child together, because no doubt you'll want your child to inherit your wife's assets.

Can I Inherit My Wife's Land?

Believe it or not, you can inherit your wife's land.

If she doesn't make a will that says otherwise, it will be passed to you. But there is a catch, and a pretty huge one at that:

You cannot register ownership of the land because you will not be given permission.

You must dispose of the land within a reasonable period (up to 1 year) to a Thai national.

If you fail to dispose of the land, the Director-General of the Land Department is authorized to dispose of the land and retain a fee of 5% of the sale price before any deductions or taxes.

Yes, you're probably thinking what I'm thinking: No one is going to give you a decent price for that land once word gets out that your wife has died and you need to offload the land within a year.

Oh, and by the way, if you're living in your wife's house, consider that Thai law sees a house as “always having an interest in the land”, so I'd pack your bags within a year before your mother-in-law kicks you out, hehe!

What About Inheriting My Wife's Condo?

It's almost the same as the deal with land:

A foreigner who acquires a condominium unit by inheritance, either as statutory heir or inheritor under will, shall acquire ownership, however, unless the foreigner qualifies for ownership under Section 19 of the Condominium Act, it is required by law that the foreigner shall dispose of the unit within 1 year from the date of acquisition.

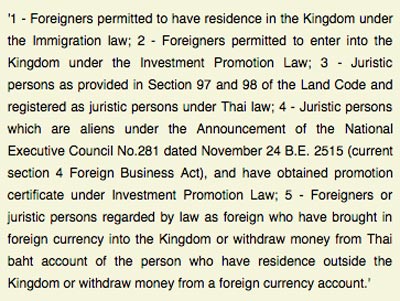

The reality is that most foreigners wouldn't qualify. Being retired in Thailand just isn't enough. See below for who qualifies:

Image Source: (Samui for Sale)

In Summary

The reality is, unless you're pretty wealthy, your estate probably won't meet the threshold for Thailand's inheritance tax.

There aren't that many foreigners naive enough to keep that much wealth in Thailand, anyway. But you may well have assets you want to make sure get passed to your wife or your kids, so making a will is a good idea.

The same goes for single people who've accumulated wealth in Thailand. You should make a will both back home and in Thailand to cover the event of your death.

Lastly, there's a number of foreigners living in Thailand who live in their wife's house, on their wife's land, drive their wife's car, and may even live off their wife's income.

If you fall into this category, then you should definitely speak to your wife about what will happen to her assets if she dies before you, because these will default to her family, in line with the statutory order of heirs outlined earlier in this post.

Getting Professional Advice

I am not an accountant, lawyer or financial advisor. This post simply represents my personal interpretation of the inheritance tax laws in Thailand.

Of course, I will make every effort to provide satisfactory responses to your inquiries in the comment section below, but it is important to note that handling IHT matters can be complex and require professional advice for a beneficial outcome.

If you find yourself uncertain about the best course of action for your tax affairs and investments, I strongly recommend consulting with a qualified professional. If you'd like, I can arrange for you to communicate with my IFA, who can offer expert guidance. If you want to get in touch, you can reach out to me via email or fill out this form.

PLEASE NOTE: If you're a UK National living in Thailand and want information about financial planning for UK inheritance tax, read this post here.

—————-

More Tips for Life Planning

Want to Start Leaning Thai?

Register a free account with Thaipod101. I use it and so do many of my readers.

Got Medical Insurance?

+ You should have. Get a quote on international cover here.

Need to send money to Thailand?

+ Go here to find out the cheapest way. Everyone is using this